The calculation of basic EPS is a little bit trickier when new shares have been issued during the financial year.

If shares were issued during the financial period, they should be included in the EPS calculation at the weighted average for the entire year.

These shares should be weighted from the date money was received from the shareholder, once the funds are received they can start contributing towards earnings.

When to Start Calculating the Weighted Average for EPS

When calculating the weighted average number of shares, start at the beginning of the year and see what shares were in use at that time.

Then adjust this figure for any shares issued during the period, and time weight these additional shares.

So if you look at the company and you had 1,000 shares outstanding at the start of the year, and issued no more shares, the average number of shares is 1,000 shares.

But what if you issue 1,000 shares halfway through the year?

Well the extra share were only in existence for half the year, so on average, we say there was a weighted average of 1,500 shares in issue over the whole year, being the 1,000 shares in place throughout the year, and the 1,000 shares which were issued halfway through the year.

It’s an average that is weighted over the length of time the shares were in issue.

So let’s work out how to calculate the weighted average number of shares.

Weighted Average: Example Calculation 1

Look at this example.

- We have 1,000 shares outstanding at 1 January

- We issue 800 shares on 1 April.

- So for the remaining nine months of the year there are 1,800 shares outstanding.

- When we look at the 800 issued shares and multiply them by 9/12 we get 600,

- and add them to the 1,000 outstanding at the start of the year,

- we get 1,600 average shares in the year.

This is how we calculate the weighted average number of shares in issue.

Weighted Average: Example Calculation 2

Another way of thinking about weighting is to think of when a good is being manufactured in a factory.

- If a company makes calculators, it’ll make them in batches, sticking on the numbers, making the moulds, popping in the computer bits.

- So let’s say it has a batch of 800 calculators, and they’re ¾ complete.

- If we were preparing the accounts for the company, we would want to express these as a whole number, so rather than saying 800 partly complete calculators, we would say, there is an equivalent of 600 calculators work in progress.

- This is the 800 calculators multiplied by ¾.

- Roughly the same amount of cost went into those 800 calculators as it would have taken to make 600 complete calculators.

- The same principle works for calculating the weighted average number of shares in issue.

When we say we had 800 shares issued for 9 months, it’s like saying we had 600 shares issued for the whole year.

Why Pro-Rata Shares by Weighted Average?

The reason for pro-rating the shares by using a weighted average is because the funds received from issuing the shares part of the way through the year were only available for use by the company for that proportion of the year.

This would not be the case if the shares were issued as a result of a share split or bonus issue.

In these cases, extra shares are given away for free, so the shares are treated as if they had been in issue for the entire year, and also used for any comparative purposes.

What is a Share Split?

What a share split does is the company takes your single share back and gives you perhaps 2 or 3 shares instead. Your share worth €50 might be split into two, and now worth €25 each.

Because you have two shares you aren’t at a loss.

What is a Share Reverse?

A share reverse is the same idea as a share split, but the other way.

Let’s say a company’s shares are €5 each, they might take back all the shares and issue a lesser number of shares instead.

In this instance they might take back their shares and issue 1 share at €10 for every two €5 shares that were previously in issue.

If this happens, the comparative figures must be adjusted as well.

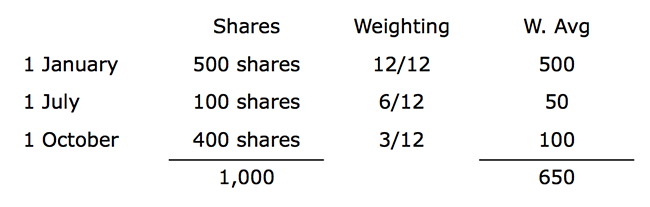

Weighted Average: Example Calculation 3

Say on 1 January we had 500 shares outstanding, on 1 July we issued 100 shares, and on 1 October we issued 400 shares.

Weighted average:

- 1 January 500 shares 12/12 500

- 1 July 100 shares 6/12 50

- 1 October 400 shares 3/12 100

- Total share in issue at y/e = 1,000 shares

- Weighted average number of shares in issue = 650

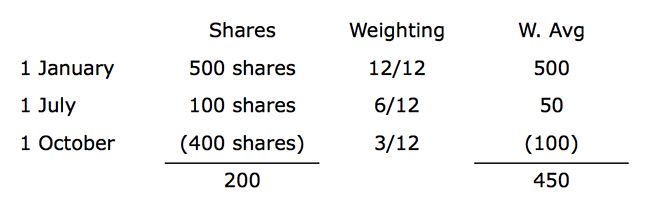

If a company buys back its shares, this is treated the same as a share issued, but in reverse, so deduct the amount of shares withdrawn.

Also make sure to adjust the weighted average for the amount of time the shares were actually issued.

So if we have a stock repurchase on 1 October of 400 shares, the shares were in issue for 9 months, the amount to deduct is 3 months.

So reduce the amount of average shares by 100 shares in the above example.

In the above example, we’ll have 800 shares in issue at the end of the year, but an average of 450 shares in issue over the year.

Weighted average:

- 1 January 500 shares 12/12 500

- 1 July 100 shares 6/12 50

- 1 October (400 shares buyback) 3/12 (100)

- Total share in issue at y/e = 200 shares

- Weighted average number of shares in issue = 450